From: John Conover <john@email.johncon.com>

Subject: Re: Exposing my ignorance

Date: Thu, 6 Aug 1998 13:12:56 -0700

>

> Say, do you have any exemplary charts that strongly display fractal

> characteristics in the trading ranges among, for a single stock, periods of

> 4-5 hrs, 4-5 days, 4-5 months, 4-5 years, and 4-5 decades.

>

Sure. What one would want to do is display fractal characteristics at

all possible ranges of time, 1 day, 2 days, 3 days, and so on. Its a

formidable computational problem, (an exercise in combinatorics,) and

thats why we invented computers.

Since a fractal is defined as the cumulative sum of a random variable,

(ie., roll the dice, add what comes up to what we have, roll the dice

again, and add what comes up to what we have, and so on,) we can

simply work backwards subtracting the previous value from the current

value, for all values in time, to investigate the random process that

made the fractal. We would then want to look at the relationship

between values that are 1 day apart, 2 days apart, 3 days apart, and

so on.

Specifically, we want the statistics of how the values, at different

day scales, relate to each other, ie., the range of deviation at

different day scales, and the standard deviation at different day

scales.

If, and only if, it is a fractal, then the range will go up with the

square root of the day scale, and the standard deviation will remain

constant. (Actually, to be mathematically precise, fractals are a

whole family of such things-the range could go up on the n'th root of

the time scale. If it is true Brownian motion-the most common type of

fractal-it will be the square root, which is the hallmark signature of

a random process, with independent increments, and a Gaussian, or

Normal, distribution.)

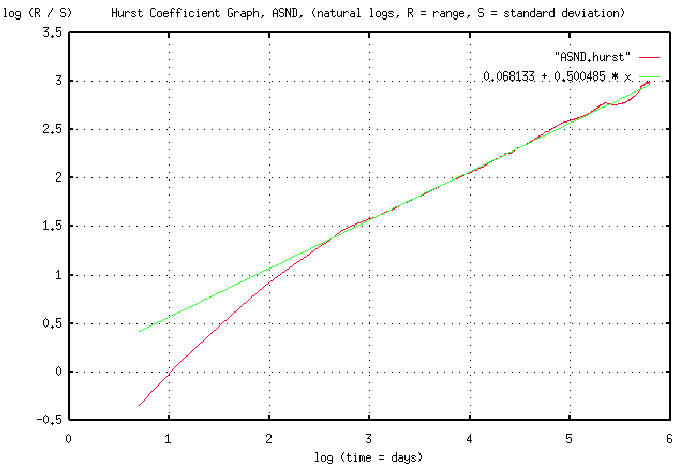

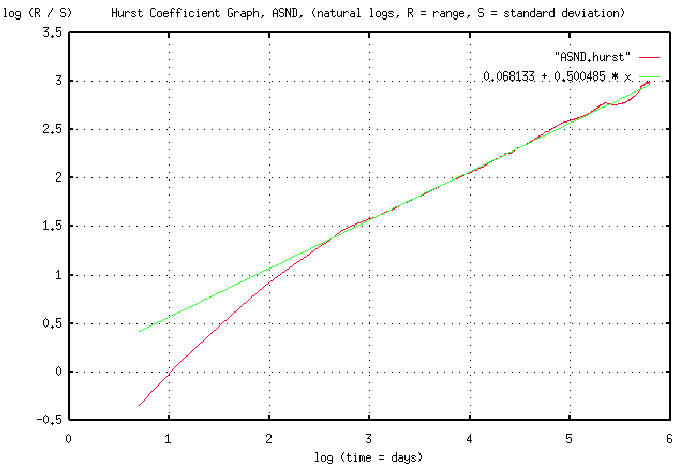

If we compute such a data set from empirical data, we would want to

plot it on log-log paper, since the square root, (or n'th root,) would

plot linear-with the slope of the graph equal to the root, n. This is

called Hurst's rescaled range/scale analysis after the hydrologist

H. E. Hurst who invented it in the 1950's. (If rain happens randomly,

and we sum the rain into a reservoir, how high do we have to build the

dam such that it doesn't overflow-that's the problem that Hurst was

working on.) The slope of the graph is called Hurst's exponent.

Attached is a graph of the R/S analysis for Ascend's (ticker ASND,)

stock value, (from 4 January, 1995 to 1 May, 1996,) with a best fit

linear approximation. (Note that the slope of the best fit linear

approximation is 0.500485. Exactly-to within 0.1%-what we would expect

from a fractal constructed by a random process with independent

increments, and a Gaussian distribution.) The graph offers very

compelling evidence that equity prices are, indeed, fractal in nature,

and the statistics of the fractal are constructed by a Brownian motion

type of process. It is in pdf file format.

John

-- John Conover, john@email.johncon.com, http://www.johncon.com/