From: John Conover <john@email.johncon.com>

Subject: Re: Electronic Components Shipments Industrial Marketplace

Date: Wed, 14 Oct 1998 21:05:33 -0700

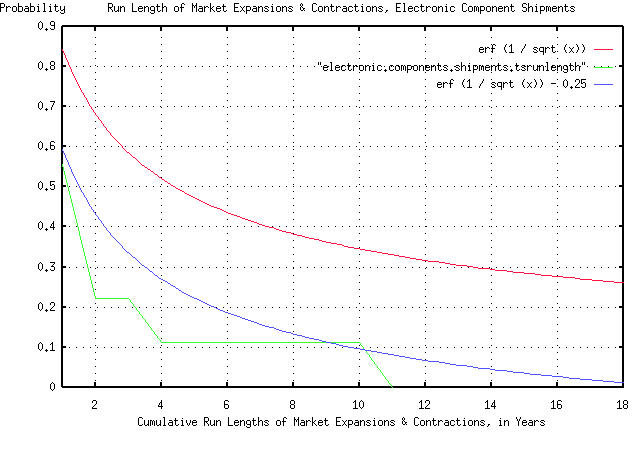

John Conover writes: > > There is one remaining question. What happens if we want to know the > characteristics of the duration of the run lengths of market > expansions and contractions in years, instead of months? > Astonishingly, it doesn't make any difference! The same rule holds > irregardless of the time scale-for which, I will offer compelling > evidence. > As counter intuitive as that sounds, it is simple to show that it is, indeed, true. Suppose I take the original data from the Department of Commerce, and only look at the data by years, ie., only look at the values of the month, say January. I had 181 data points, that contained 16 January values. I have to offset the graph to account for there being only 16 data points, as before, by 1 / sqrt (16) = 1 / 4 = 0.25. The graph is compelling:

As before, all the graph means is that if you want to find the chances

of the duration of an industrial market expansion or contraction being

longer than, say four years, you find 4 on the x axis, move up to the

graph, and left to the y axis, and read about 0.5 = 50%. There are

three graphs displayed. The "real" graph is erf (1 / sqrt (t)), and is

the graph that should be used. The graph erf (1 / sqrt (t)) - 0.25 is

what we would expect to see if our data was 16 years, and the

remaining graph is the empirical data from the Department of Commerce,

which consisted of 16 years. All in all, a respectable "fit" of

empirical data to our theoretical model-particularly considering the

data set size was only 16 data points.

So, the assumption that our model of the duration of expansion and

contraction intervals in industrial markets can be calculated as

having a probability of happening of 1 / sqrt (t) seems to be

intuitively justified, irregardless of whether we are talking in

months or years.

John

--

John Conover, john@email.johncon.com, http://www.johncon.com/