From: John Conover <john@email.johncon.com>

Subject: Re: Electronic Components Shipments Industrial Marketplace

Date: Wed, 14 Oct 1998 23:37:47 -0700

John Conover writes:

>

> The model is that duration of the fluctuations in industrial markets

> have a probability of 1 / sqrt (t). It is not complicated. What's the

> probability of a "recession" lasting longer than four months? 1 / sqrt

> (4) = 1 / 2 = 50%. And longer than two months? 1 / sqrt (2) = 0.707 =

> 71%. How about longer than seven months? 1 / sqrt (7) = 0.378 = 38%.

>

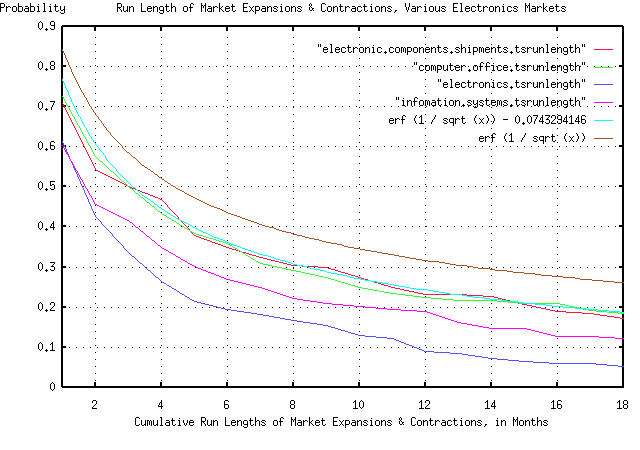

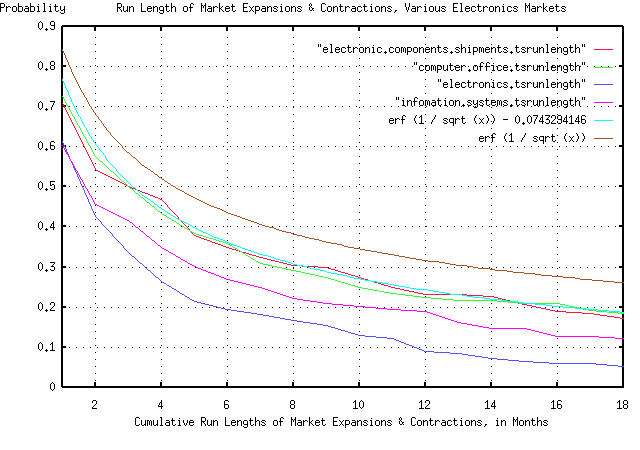

But how well does the model work in other markets? A reasonable

question. So, I used additional data available through the Department

of Commerce, and made a composite overlay graph. The industrial

markets were selected from the electronics industry:

MSEL367X: Electronic Components and Accessories Shipments

1980-1995, by the month.

IP357XXX: Computer & Office Equipment Industrial Production

1982-1995, by the month.

MNELELEC: Total Electronics New Orders 1980-1995, by the month.

MSELINFS: Information Systems Shipments 1979-1994, by the month.

The methodology used to make the graph was identical with the

methodology used in the previous graphs. Again, the graph is

compelling:

As before, all the graph means is that if you want to find the chances

of the duration of an industrial market expansion or contraction being

longer than, say four months, you find 4 on the x axis, move up to the

graph, and left to the y axis, and read about 0.5 = 50%. There are

six graphs displayed. The "real" graph is erf (1 / sqrt (t)), and is

the graph that should be used. The graph erf (1 / sqrt (t)) -

0.0743294146 is what we would expect to see if our data set was 181

months, and the remaining graphs are the empirical data from the

Department of Commerce, which consisted of 181 months, for the various

electronics markets. All in all, a respectable "fit" of empirical data

to our theoretical model, particularly when considering that each

empirical data set consisted of only 181 data points.

So, the assumption that our model of the duration of expansion and

contraction intervals in industrial markets can be calculated as

having a probability of happening of 1 / sqrt (t) seems to be

intuitively justified, irregardless of whether we are talking in

months or years, or any other industrial market.

John

--

John Conover, john@email.johncon.com, http://www.johncon.com/