From: John Conover <john@email.johncon.com>

Subject: Fractal "bubbles", Re: Business News from Wired News

Date: 30 Dec 1998 05:37:56 -0000

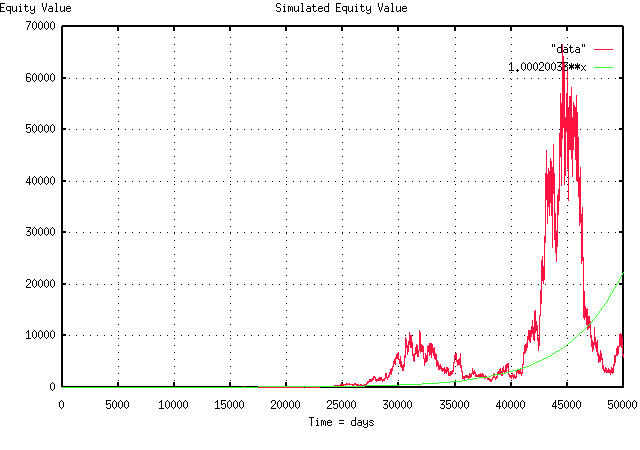

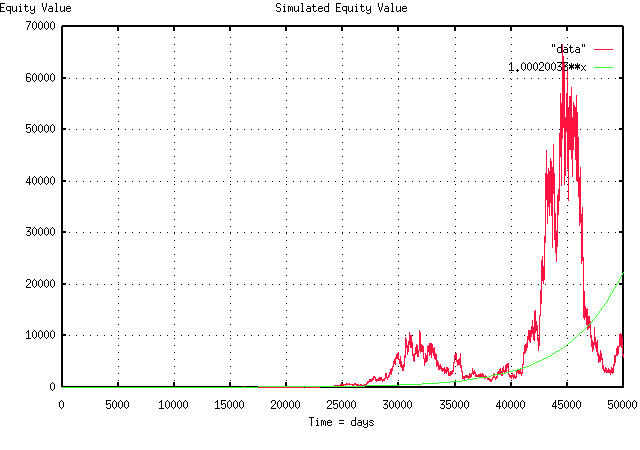

If you don't believe fractals can have bubbles, look at the attached

PDF graph. What I did here was toss a thousand coins in the air,

(well, actually, I used a computer's random number generator,) and

added the difference between the number of heads and tails, to the

current value of the stock, to get the stock's value for the next

day. I did this 50,000 times, to simulate an equity's value, over

time-about 200 years worth. (In technical jargon, I used the

cumulative sum of a binomial distribution to simulate a fractal with

Gaussian/normal distributed marginal increments, eg., a simple "random

walk" model.)

Ten of the thousand coins had heads on both side, giving an average

marginal return of 1.0004 per day, with a volatility of marginal

return of 2% per day, which is the average of all stocks in the

NASDAQ, NYSE, and AMEX for the century, (ie., the likelihood of an up

movement, P, in the stocks value on any day is 51%, the avg = 0.0004,

and the rms = 0.02, and P = ((avg / rms) + 1) / 2, where avg = rms^2.)

This means that the stock's gain in value is 1.000200033 per day, or

about 0.02% per day-in case you want to relate it to a compound

interest scenario.

I let the simulation run until I got a nice, big, bubble-beginning at

about 42,000 days, and ending at about 47,000 days, or a bubble run

length of about 20 years. During this time, the fractal was about an

order of magnitude above "where it should be", ie., its real average,

which is the smooth line in the graph, (the green graph, if you have

color.)

John

BTW, most bubbles in the simulation lasted about 4 years-some less,

some more, depending on how one judges what a bubble is-I just let the

simulation run long enough to get a big one to impress you. The

chances of a big one increase with the square root of time. The

chances of a zero crossing of the real average go down with the square

root of time, and the chances of finding a long run length bubble goes

down with the reciprocal of the square root of the bubble's run

length. The deviation of the fractal from its real average diverges

with the square root of time, and on average, the fractal's maximum

divided by its minimum will be a factor of two in any year, and the

range, ie., maximum - minimum, scales with the square root of time,

for values larger than a year. The stocks on the NASDAQ, NYSE and AMEX

have these characteristics to many orders of magnitude precision, (but

there are minor discrepancies, so don't jump to conclusions-its not

exploitable, anyhow.)

-- John Conover, john@email.johncon.com, http://www.johncon.com/